The chain of events of the previous three years has significantly affected the entire global market. As part of the world economy, international shipping has suffered many painful blows and has inadvertently inflicted some on the downstream links of the chain.

Three problematic years

Three problematic years

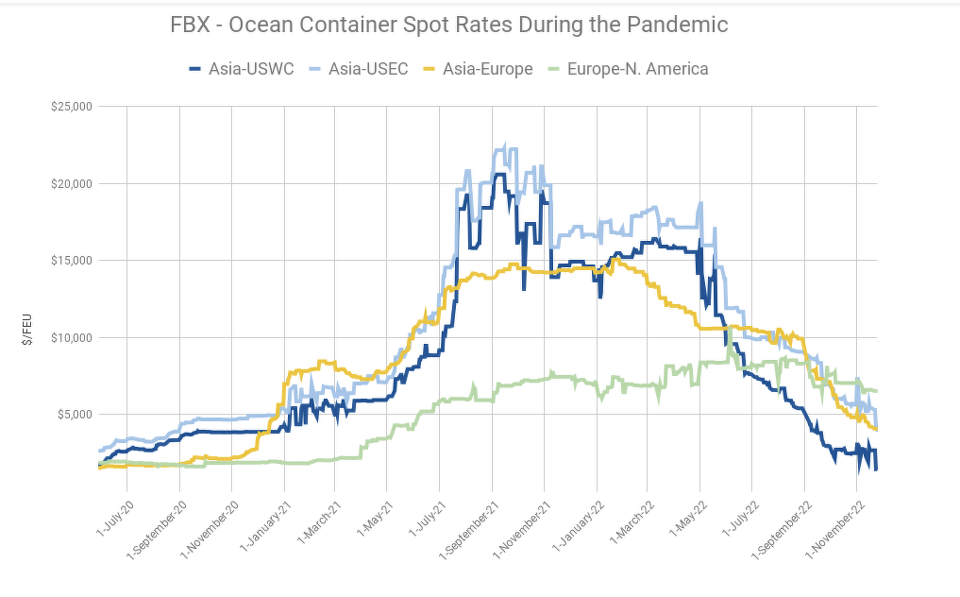

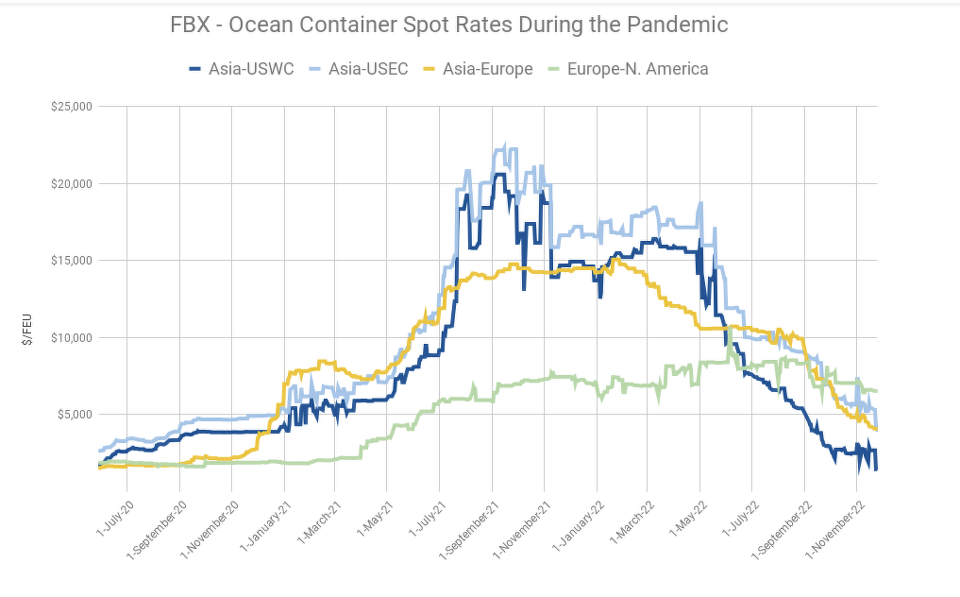

Cancellations, changes in ship schedules, flight schedules, rail connections and problems on the road, zero tolerance of covide in China, war, rising energy and fuel prices, staff shortages, insufficient capacity of transport means, shippers' strategies. These are just a basic list of the problems that have resulted in the extreme cost of international shipping from distant markets. Martin Tokič, Director of Geis CZ Air+Sea, says: "This literally lethal mix of influences has driven the cost of shipping to unprecedented levels between 2020 and 2022, especially on routes between Asia and Europe and Asia and North America. However, this began to change around the middle of last year."

2023: Prices drop several times

It is now safe to say, with a slight eye-opener, that both ocean and air freight prices are at pre-cold levels. There are two reasons for this significant drop in prices compared to the peak period: lower demand and the slowly disappearing confusion in supply chains. People have started to cut back on their purchases, real wages are falling and they don't know what will happen. Even the classic pre-Christmas season and the associated high load on operators did not come last year.

However, the current sales problem has not only affected Europe. Almost the entire globalised world is feeling the low demand. This was also discussed at a logistics conference held in Singapore, Asia, in February this year. Martin Tokič confirms: "In Singapore, I had the opportunity to meet with partners from many countries across the continents and the conversations were often in a similar vein, i.e. about weak demand, low volumes, inflation, etc."

Some factories in Asia have not started production after the local holidays in October 2022. The brewers have excess capacity and are unable to fill it, so they have to discount. However, it should be mentioned that their profits from the last two covid years have been extreme. For example, it is estimated that in 2021, stevedores will double the profits they generated between 2010 and 2020.

Not only price and demand play a role

Port closures and handling problems are no longer such a major issue, not least because China slowly began to relax its strict zero-tolerance covide measures at the end of the year. Also, airports are not accumulating huge amounts of cargo as passenger flights are again commonly used to transport them. Unfortunately, however, there is still a shortage of staff, particularly in air transport, and the outlook is not good.

The 'E': Energy and ecology

Of course, it is not just international transport that has been hit by the significant rise in costs, but the logistics sector in general. Intermodal transport is a good example of today's instability. In fact, during the year there were several adjustments to the price lists for combined rail transport to/from EU ports. This was influenced by the price of traction power, the price of fuel and the overall cost of infrastructure maintenance. Another important issue is how the increasing pressure on environmental performance will continue to be reflected in prices. For example, various "eco" charges are already included in the price of shipping. This is primarily justified by the fact that ships of an older date of manufacture have to be fitted with equipment that reduces the emissions produced. On the other hand, new ships are already being manufactured to meet such standards. Also, the cost of 'green' fuels is higher. Although environmental issues are a big topic at the moment, price still wins in international shipping. However, the question is how much longer it will be possible to choose between the cheaper and the greener option.

Warehouses full of expensive goods, new goods are cheaper

Europe is full of warehouses full of older goods that companies imported from far away last year. Now newer products are coming onto the market, and they are cheaper. Although production costs rose quite dramatically last year, the new goods are still cheaper than the imported ones, whose price has been significantly affected by expensive transport. Although some companies have started to consider moving production closer to the sales market (i.e. to Europe), or have even implemented such a move, there are not many of them. "Such a thing does not happen overnight. It is a strategic decision that fundamentally changes the company's processes, which is why many manufacturers eventually abandoned it. Alternatively, they leave part of their production in Asia and move the other part closer to their customers," adds Tokič.

Will we be saving money for a long time?

The current level of international freight prices is at its lowest level in several years. Tokič says: "I would say to companies that use sea freight, for example, that there is nothing to wait for. Take advantage of the current low prices and available capacity."

Although supply chains have almost straightened out and the reliability of cargo deliveries has increased significantly, the outlook for the future is not entirely positive. Given the overall developments in the world, an economic slowdown is inevitable. At the same time, positive signs can already be perceived - the rate of inflation growth has slowed down, and it is not only the Czech National Bank that predicts a reduction of several percentage points. The question is how this will again affect demand and people's willingness to spend. However, as we have seen in recent years, any prediction of future developments, even in international shipping from distant markets, is difficult to defend.

Three problematic years

Three problematic years